The Dubai Land Department (DLD) recently launched the pilot phase of its Real Estate Tokenisation Project. Part of the Real Estate Innovation Initiative, this marks the department as the first in the Middle East to integrate Tokenisation into property title deeds.

The DLD anticipates that this pioneering initiative will fuel substantial growth in the real estate Tokenisation market, with projections indicating a market value of AED 60 billion by 2033, accounting for 7% of Dubai’s total real estate transactions.

The DLD is launching the Real Estate Tokenisation Project in collaboration with the Dubai Virtual Assets Regulatory Authority (VARA) and Dubai Future Foundation (DFF) via SandBox Real Estate. The DLD, through the Project, reinforces its commitment to the Dubai Economic Agenda D33, which focuses on adopting digital solutions.

What is real estate Tokenisation?

Real estate Tokenisation uses blockchain technology to convert property assets into digital tokens, allowing investors to own fractional shares of a property based on their budget and financial strategy. This approach enables property ownership without the need to purchase an entire building, leveraging advanced technology for greater flexibility.

Unlike crowdfunding, which provides access to real estate with smaller investments through digital platforms, Tokenisation offers a more structured model for real estate investment.

An SPV would usually be created to own and hold the asset which would then issue tokens that represent fractional ownership of the asset. This is similar to a REIT but with a blockchain-based, Tokenised twist.

UAE: Leading the Charge

Several Dubai-based companies have already ventured into tokenising real estate. For example, Smart Crowd, a crowdfunding platform, offers investors the opportunity to buy fractional ownership of income-generating real estate in Dubai, using blockchain to increase transparency and efficiency in transactions.

Additionally, Propy, a global real estate platform, has launched blockchain-based real estate solutions in the UAE, allowing properties to be bought and sold using digital tokens, further cementing Dubai’s position as a leader in this space.

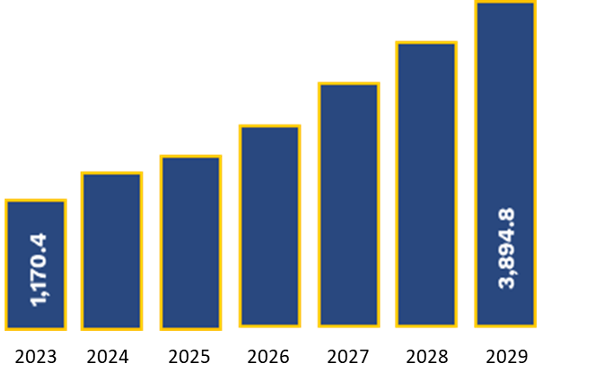

The global real estate Tokenisation market is expected to reach$3894 billion by 2029, growing at a rapid pace. The UAE, known for its tech-driven innovation, is at the forefront of this change

Global Real Estate Tokenisation Market Value and Forecast (US$ Bn)

Source: medium.com

The many benefits of real estate Tokenisation

One of the most significant benefits of Tokenisation is the ability to fractionalize ownership in real estate. Investors can own a portion of a property without needing to invest the entire capital required to purchase the property outright.

Real estate has long been considered an illiquid asset class, with transactions often taking months or even years to complete. Tokenisation provides liquidity by allowing real estate tokens to be traded on secondary markets. This creates the opportunity for quicker purchases and disposals, making it easier for investors to deal with the asset without the typical delays of transactions in traditional real estate markets.

Tokenisation also removes geographical and financial barriers to entry, enabling global investors to participate in real estate markets they may not otherwise had access to. Furthermore, the use of blockchain ensures full transparency, as all transactions are publicly recorded and cannot be altered, providing a higher level of trust and security for investors.

Traditional real estate transactions involve various intermediaries—agents, lawyers, banks, etc.—all of which add costs and time to the process. Tokenisation eliminates many of these intermediaries by relying on blockchain technology and smart contracts, reducing transaction fees and increasing efficiency.

With Tokenisation, investors can easily diversify their portfolios by owning fractional shares in multiple real estate properties across different markets. This diversification helps spread risk and can lead to more stable returns over time.

Surely, there must be a catch?

From a legal perspective, Tokenisation in real estate introduces a complex range of issues, given the involvement of both emerging blockchain technologies and traditional real estate law.

1. Regulatory Framework and Compliance

The legal framework surrounding Tokenisation is still evolving which can cause potential compliance issues. A big legal challenge with tokenising real estate is determining whether the tokens are considered to be securities under local laws. In many areas, if the tokens represent ownership or offer a share of income or profits (such as dividends), they could be classified as securities. In which case, strict securities laws, including rules on registration, disclosure, and investor protection would need to be followed.

Tokenised real estate platforms also have to follow Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. This means they must make sure investors aren’t involved in money laundering or illegal activities. To do this, they need to verify investors’ identities and keep an eye on transactions for any suspicious behavior.

2. Title and Ownership Rights

In many jurisdictions, real estate ownership is linked to a physical deed or legal document that’s recorded in a government land registry. Tokenising an asset means turning the ownership into a digital form, but this may not correspond with traditional legal titles, which are recorded in government databases. This creates challenges around title transfer and legal recognition of Tokenised ownership, especially in areas where digital tokens aren’t yet accepted as legitimate ownership.

Integrating blockchain-based ownership within the government systems also adds a layer of complication especially given that not all jurisdictions are equipped to handle this mixed model.

If ownership isn’t clearly defined in legal terms, disputes could arise between token holders, developers, or others involved in a property transaction. There’s also the risk that a court might not recognize blockchain-based ownership, which could make it difficult to resolve legal issues in cases of fraud or ownership conflicts.

3. Technology Risks

Cybersecurity – whilst blockchain itself is secure, the platforms and exchanges that handle Tokenised assets can be vulnerable to cyberattacks, hacking, or fraud which may not be as common in traditional real estate transactions due to the fact it is heavily regulated.

Smart contracts – these are self-executing agreements where the terms are written directly into code. They can automate matters such as property transfers, payments, or dividend distributions in real estate. However, in the event of a cross-border transaction, as the rules in respect of smart contracts vary across jurisdictions there could be some uncertainty as to how smart contracts should be recognized or enforced. In addition, some jurisdictions may not have clear regulations or precedents for smart contracts yet, making it harder to enforce them in court.

The decentralized nature of blockchain also creates jurisdictional challenges. If a real estate token holder is in one country and the property is in another, figuring out which legal system governs the contract can become complicated. This raises questions about how disputes should be resolved and whether smart contracts can be enforced across borders.

4. Taxation

Authorities around the world are still determining the appropriate methods to deal with Tokenised real estate when it comes to taxes. Determining taxes such as capital gains tax, stamp duty land tax, and income tax from rental income or profits can become tricky when the property is split up into tokens. The tax treatment may also depend on whether the tokens are categorised as securities, commodities, or something else entirely.

Another challenge is withholding taxes. If token holders are from different countries, taxes on rental income, dividends, or capital gains can become complicated. International tax laws come into play, and given that the handling of taxes in cross-border transactions can vary this can add a further layer of complexity.

5. Consumer Protection and Investor Rights

Tokenised real estate can make investing in property more accessible, but many investors might not fully grasp the risks involved. Without a clear regulatory framework for this asset class, it could be difficult to protect investors from matters such as fraud or defaults.

The lack of clear regulations can open the door for fraudulent schemes, where scammers create tokens for fake or misrepresented properties. Without adequate oversight, investors may have no legal recourse if the property doesn’t exist or if a developer misappropriates their money.

Additionally, if token holders are harmed in the event of fraud or mismanagement, pursuing a class action lawsuit or seeking legal action could be tricky due to the decentralized, digital nature of token ownership.

6. Property Management and Governance

Tokenised real estate means that multiple token holders may have a say in matters such as property management, leasing, or maintenance decisions. Consequently, this decentralized method of governing could conflict with traditional property ownership laws, where typically just one or a few people or entities have decision-making power.

There can also be legal issues if a decentralized group or token holders are making management or operational decisions that

impact tenants, buyers, or other stakeholders. It’s important to clarify how authority is assigned and who is ultimately responsible for the property legally.

7. Cross-border Legal Challenges

Tokenised real estate can get tricky because real estate laws vary from country to country. Each jurisdiction has different legislation in respect of land ownership, property rights, and how digital tokens are treated. To make Tokenised real estate work across borders, international legal coordination would be needed.

In addition, given that the regulations can vary across jurisdictions, it can lead to regulatory arbitrage, where developers and investors may choose to tokenise properties in places with more relaxed laws, which could create differences in investor protection and tax responsibilities.

8. Market Volatility

Real estate tends to be a relatively stable asset class, but Tokenised real estate might still experience volatility due to the speculative nature of blockchain markets or fluctuations in cryptocurrency prices creating some uncertainty when investing.