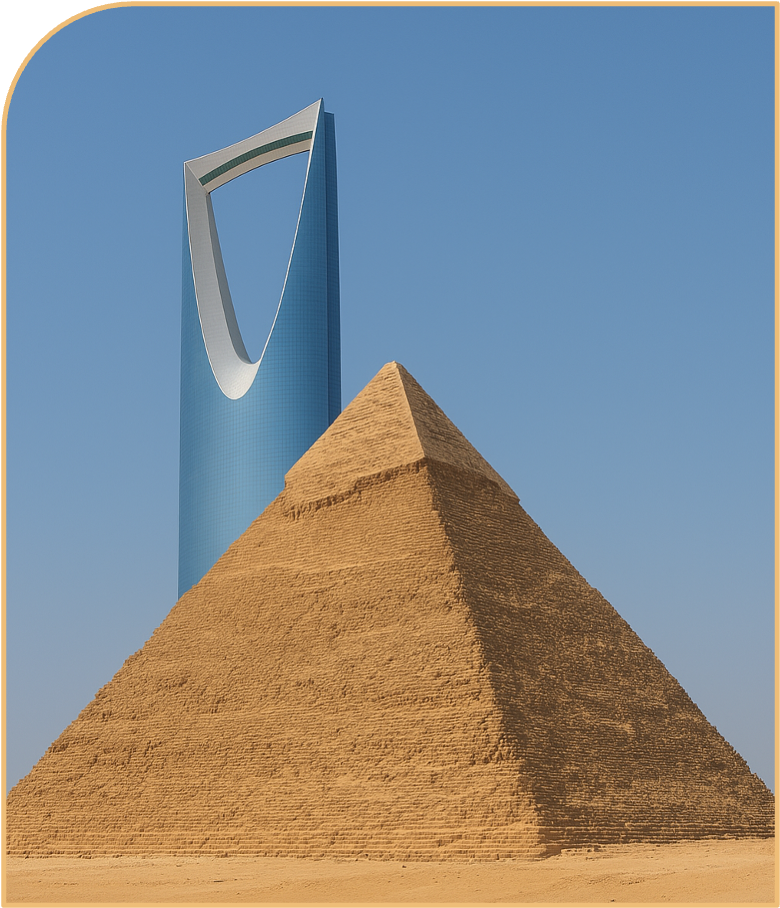

Egypt – Saudi Arabia Bilateral Investment Treaty Signals Stronger Economic Ties and Legal Certainty

The Arab Republic of Egypt and the Kingdom of Saudi Arabia have officially entered into a new Bilateral Investment Treaty (BIT) designed to promote and protect cross-border investments between the two states. Signed on October 15, 2024, and entering into force on June 4, 2025, the treaty introduces a modern, investor-friendly framework that reflects both states’ commitment to economic integration and legal certainty for investors.

A modernised definition of investment

The new EGY–KSA BIT takes a broad and contemporary approach to defining “investment,” aligning with global standards and investor needs in today’s interconnected markets. It extends protection not only to direct ownership of assets but also to indirect shareholdings, reflecting the reality of multinational corporate structures and cross-border holdings.

Critically, the treaty adopts the “Salini” criteria, a well-established test in international investment law that evaluates:

- Substantial contribution

- Duration

- Risk

- Contribution to the host state’s development

This test ensures that only genuine, value-adding investments qualify for protection under the treaty, adding a level of rigor that benefits both jurisdictions and credible investors.

The BIT also details specific types of assets eligible for protection, including:

- Investment projects where the investor holds over 50% ownership and control

- Shareholdings equal to or above 20%

- Bonds and project loans

- Intellectual property rights

- Legal rights and concessions

- Real estate and related property rights

- Monetary claims and contractual performance rights

Investor qualification: nationality rules refined

In line with best practices, the BIT refines the definition of who qualifies as an “investor.” For natural persons, the treaty applies the “dominant and effective nationality” test in cases of dual nationality, helping clarify jurisdictional ambiguities.

For juridical persons, the BIT opts for a more substantial connection test, focusing on the “siège social” (main seat of business operations) rather than mere place of incorporation. This is an increasingly important distinction in modern investment structures.

Strong standards of investor protection

The BIT ensures a robust framework of substantive protections for investors, including:

- National Treatment and Most-Favored-Nation (MFN) provisions

- Fair and Equitable Treatment (FET)

- Protection against unlawful expropriation

- Freedom from discriminatory or abusive measures

- Rights to promote, establish, and operate investments freely

These protections collectively elevate the treaty to a high-standard investment instrument, offering legal security to investors from both Egypt and Saudi Arabia.

Structured and balanced dispute resolution

One of the standout features of the treaty is its carefully designed Investor-State Dispute Settlement (ISDS) mechanism. While it allows investors to pursue arbitration under ICSID or UNCITRAL rules, it balances access with clear procedural safeguards:

- An extended Cooling-Off Period of 18 months, followed by a mandatory 90-day notice before initiating arbitration.

- Exclusivity of forum — disputes must not be simultaneously or previously submitted to other courts or tribunals.

- Jurisdictional limits — tribunals cannot rule on the legality of state procedures; such matters are treated as facts.

- No moral damages — awards remain commercially grounded.

- The treaty permits interim measures to preserve investor rights, a progressive feature not typically included under ICSID rules.

- A three-year limitation period applies for initiating claims, promoting timely resolution and legal finality.

A step toward economic integration and confidence

The EGY–KSA BIT represents more than a legal framework — it is a strategic declaration of the growing economic partnership between two of the MENA region’s most influential economies. By embedding high standards of investor protection, legal clarity, and dispute resolution, the treaty strengthens the investment climate and encourages sustainable foreign direct investment (FDI) across both nations.

A positive outlook for regional investment

From a legal and commercial standpoint, the new EGY–KSA BIT sets a progressive and balanced precedent. It offers investors a clear, dependable roadmap for entering and operating in either market, while preserving state sovereignty through well-defined limitations and procedural safeguards.

As both states pursue ambitious economic development agendas — namely, Vision 2030 in Saudi Arabia and Egypt’s Vision 2030 — the BIT is poised to be a cornerstone of cross-border investment collaboration, deepening economic ties and fostering a mutually beneficial environment for private sector growth in the region.

Bilal Ambikapathy

Partner

T: +966 56 4088 719

+973 3947 8355

+971 585 3947 83

E: bilal.ambikapathy@wisefieldslaw.com

Omar Abou Taleb

Partner

T: +20 122 110 6122

E: o.aboutaleb@aboutaleb-legal.com